Why women in Australia are retiring with less - and how to change it with Debby Blakey

Together, we dive into the big issues women face today and look at the practical steps we can take to plan for a secure retirement.

HESTA are the sponsor of the Prime Time podcast — and we love their support. Here’s a little message from them to get us started… My longer message is below!

HESTA has products and services to help you retire your way

Most people think that their super fund retires when they do. So, they withdraw their money or stop looking for ways to increase its value.

But did you know that keeping your super in your super fund after retirement can continue to generate returns?

With HESTA, our specialised services and products mean your super keeps working, long after you stop. Whether retirement is just around the corner, or still a few years away, HESTA can help you get the most out of your super.

HESTA – Super with impact™. Learn more at hesta.com.au/impact

Why women in Australia are retiring with less - and how to change it with Debby Blakey

Today, we’re tackling a crucial and challenging topic—how women are retiring with less, and what we can do to change that. I’m joined by Debby Blakey, CEO of HESTA, a strong advocate for women in the workplace and for equality in superannuation. Together, we dive into the big issues women face today and look at the practical steps we can take to plan for a secure retirement, like finding the right advice, using the right resources, and making smart super decisions.

We also get into the deeper issues that hold women back in retirement savings, and what we can all do to drive real change. This conversation is both practical—offering things women can start doing now to build their retirement security—and visionary, as we explore ways to make sure women are better valued for the roles we play both in the workplace and at home.

LISTEN TO THIS EPISODE OF THE PODCAST HERE:

Highlights of the conversation:

We start by exploring how women’s retirement needs often differ from men’s as they approach retirement—and why it’s essential to address these differences head-on.

The policy changes that could have a huge impact on women’s lives.

Where should women start when they’re looking for superannuation advice tailored to their needs?

Confidence is critical in navigating retirement planning. There’s a huge need to build the confidence of women. In fact, Debby says all women should prioritise building on their financial confidence and set themselves on the path to becoming ‘retirement ready’.

What resources and tools are out there that make managing and growing super easier—and more effective? We explore the digital tools that people can use to test out the impact of their decisions like making earlier payments into super or leaving work earlier.

How people really access advice — and what people ask for when they call HESTA, because most people don’t call up and ask for advice — they ask for ‘help’.

Debby shares three really good ideas and practical tips that people can implement today to boost their retirement savings, no matter where they’re starting from.

We explore what women need to fight for and how women can advocate for greater fairness and equality in superannuation—because a secure retirement should be achievable for all. There’s a whole package of issues around equality that need women to be ‘louder’ on.

Debby is passionate about how we value women for their contribution we make to society when they take time out of the workforce to care for children - and she talks to the concept of care credits — something she and HESTA have been lobbying for.

And, of course, we dive into the number one question women ask their superfunds — in fact, she’s broken it into two terrific questions.

This conversation with Debby is packed with game-changing insights, practical steps, and the knowledge women need to own their financial future. Big thanks to Debby Blakey for bringing her expertise, clarity, and passion to help women create a stronger retirement.

If you’ve got something to say on the topic of women and super — leave your comments on the post here.

From Bec’s Desk

Talking with Debby Blakey this week made me realise just how crucial it is for everyone to understand if—and how much—taking time out of the workforce has impacted their super. Knowing this not only strengthens our case for policy change but also motivates each of us to take a closer look at our super and make improvements sooner rather than later.

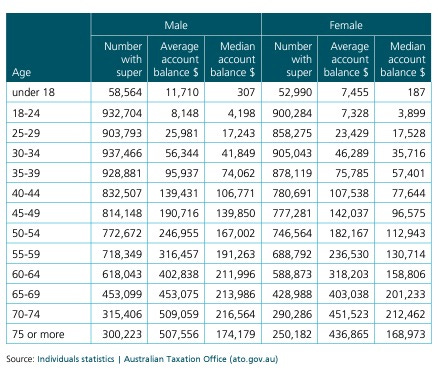

It sent me digging into data on average super balances, so we can all check whether our own balances are above or below the average. This table from ASFA and the ATO highlights the real situation facing women.

Superannuation balances by age and gender, 2021

The real number to look at is the median account balance — because averages can be skewed by a handful of larger balances. As you can see, women in every agegroup are worse off.

Now that you’ve assessed your own situation, take a minute to answer the poll — to help everyone grasp the scale of the issue.

In other news this week, I tackled a tricky subject over the weekend and took some flack from online trolls. I shared my take on the new advertising campaign from the Financial Advice Association, the FAAA, which encourages people to disregard finfluencers and seek professional financial advice. My view? I don’t like finfluencers either — I do think we need to talk more about quality self-help education and financial literacy though. I think we should prioritise educating people to build their financial literacy, so they’re empowered to make informed choices without always needing to queue up for one-on-one advice—especially when it’s in such short supply. This way, people can recognise when advice is useful or necessary and find the type that suits them best at that time. Sometimes that advice can come from their superfund and sometimes from independent advisers — depending on the issue they’re facing at the time.

“Is this the missing link for cheap, effective financial advice” - in the Sydney Morning Herald and The Age. The article is unlocked for all to read. See if you agree with me.

Now - get on in and listen to Debby Blakey - she’s impressive.

Catch you next week, and in the meantime, make your Prime Time count!

Many thanks! Bec Wilson

Author, podcaster, guest speaker, retirement educator … Visit my website for more info about me, here

PS - Starting to think about Christmas gifts? We’ve just launched the ability to purchase ‘signed copies’ of How to Have an Epic Retirement. Check out the shop here.

There were only 17 responses when I completed the survey but the significant (82%) number of people with above the median super balances suggests that any group of people who engage with a retirement site (us Primetimers) might be more likely to be engaged in their financial future.

Whenever I hear of single mothers struggling to support their children I wonder where the fathers of these children are. What has happened to helping support your children? Why are so many men so reluctant to actually be responsible for their children? Greater awareness and education for women is needed. As shown by the super balances table women need to be more proactive about their financial futures - stop letting these fathers not pay their fair share - if you stopped working to have children their fathers should be contributing to your super. Men - don't let your children and their mothers live in poverty.