New super savings targets: how much you really need to retire

In this episode we chat with Xavier O'Halloran about the new Super Consumers Australia benchmarks on how much you need in savings when you retire to afford your desired cost of living.

Ever wondered how much you really need to retire or how the age pension fits into the mix for retirement income? Do you want to understand a bit more about the benchmarks really mean for retirees? Then you’re going to love this episode.

In this episode of Prime Time, we dive deep into Super Consumers Australia’s retirement savings benchmarks with CEO Xavier O’Halloran. But we don’t just cover the numbers for homeowners and Age Pension recipients—we also break down what retirement looks like for renters and those who may never qualify for the Age Pension.

Super Consumers Australia released a whole new set of retirement benchmarks just a couple of weeks ago — and these new benchmarks also include some real guidance on how much of your income will probably come from the age pension during your retirement. It’s interesting stuff. When I covered these numbers in the Epic Retirement Newsletter recently, the response was overwhelming—people wanted to know more. So today, we’re unpacking how these benchmarks were created, what they really mean, and how the different levels within the benchmarks work to guide you.

LISTEN TO THIS EPISODE OF THE PODCAST HERE:

Highlights of this episode

Why there’s no single ‘magic number’ for retirement savings and why different benchmarks exist

How super and the age pension work together to provide a retirement income

Benchmarks for homeowners - those in pre-retirement and those approaching retirement right now

Some guidance for renters and those who don’t own their own home on how to budget.

Insights for those who will never qualify for the age pension on how much they need to retire.

How Super Consumers Australia built their benchmarks using real-world data from retirees, not assumptions

How much you need for different levels of retirement spending

Homeowners vs. renters – why renters need to save almost 1.5 times more

Singles vs. couples – how retirement costs differ based on household situation

What typical retirees actually have in super and whether they’re on track

Who gets the age pension and who doesn’t, with some common myths debunked

The surprising number of people missing out on the age pension and how to avoid leaving money on the table

The impact of home ownership on retirement security and why it’s the elephant in the room

Rising aged care costs and future policy changes that could impact retirement plans

The reality of longevity risk and why planning to live longer than expected is a smart financial move

This episode is a must-listen for anyone thinking about how they’ll fund their retirement.

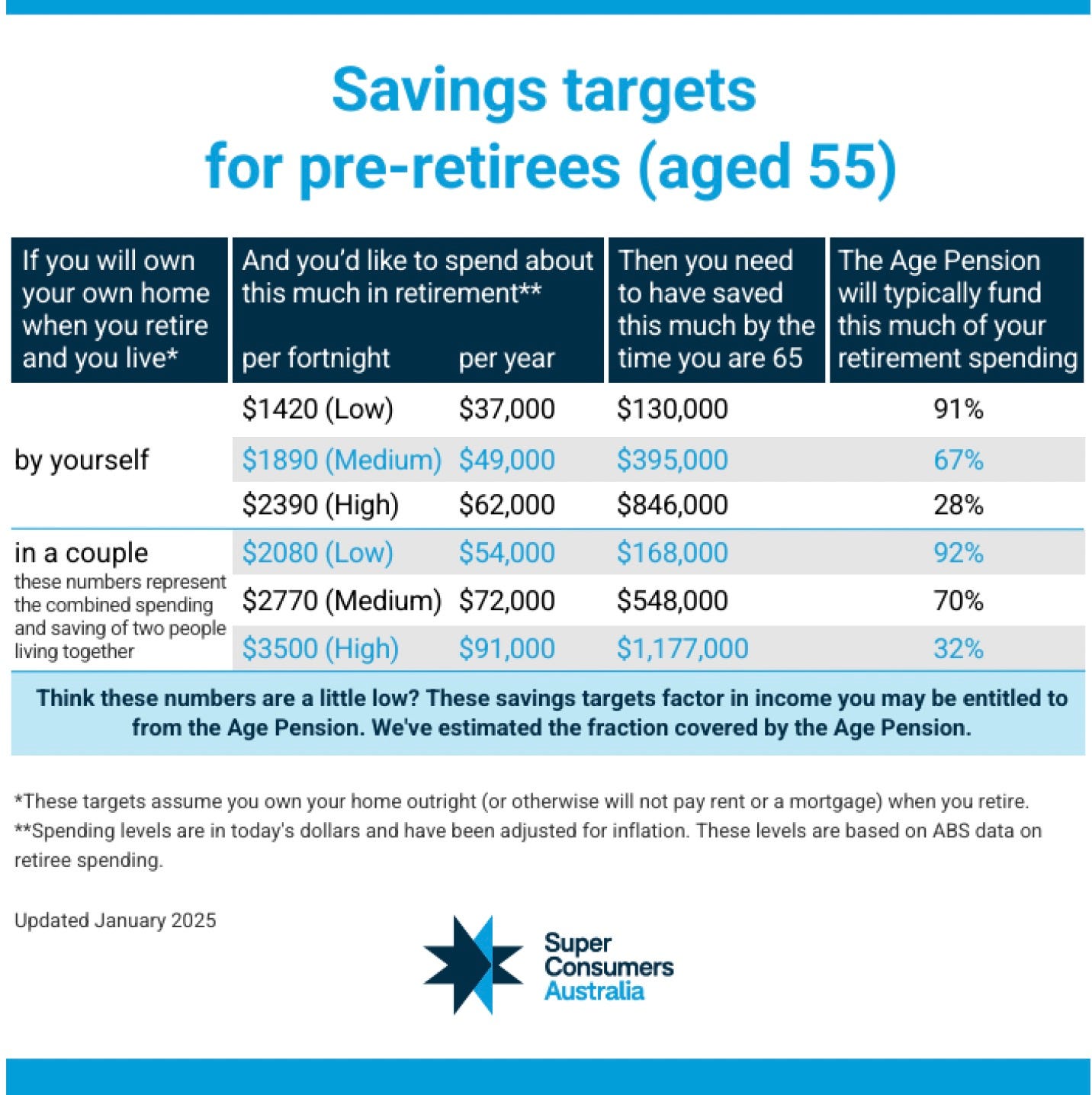

To support this episode I am delighted to share the Super Consumers Australia benchmarks released in January 2025 below.

Final call for the How to Have an Epic Retirement Flagship Course

Our next How to have an Epic Retirement Flagship Course kicks off next week - on the 13th February 2025 and runs for six weeks until the 27th March 2025. We’ve got some amazing guests for our Live Q&As, and the program has been updated and improved for 2025.

So get on over and book in your place. We still have time to get you your welcome pack - so move fast! AND use the coupon code LASTMINUTE15 to get yourself a better price.

➡️ Book your place on the website here

How much super do you need to retire?

New figures from Super Consumers Australia show that strong super returns and the Age Pension are helping keep many Australians on track to meet their retirement income needs—even with the rising cost of living.

Super Consumers Australia has just updated its homeowner retirement savings targets, giving Australians a clearer picture of what they need to retire comfortably.

According to their latest benchmarks:

A single retiree needs around $310,000 in super to generate an annual income of $43,000

A couple needs around $420,000 in super to generate an annual income of $62,000

These figures assume retirees own their home and are combining their super with Age Pension payments, which form a significant part of most people’s retirement income.

Xavier O’Halloran, CEO of Super Consumers Australia, explains:

"Most people will access the Age Pension at some point in retirement. When combined with super earnings, the retirement system is designed to provide long-term protection against cost-of-living increases. These figures give people greater confidence to enjoy the income they’ll receive in retirement."

Super returns have also helped Australians keep up with rising costs. The savings targets for 65-year-olds with medium or high spending needs have increased by 10–15%, but many people with super in a balanced fund would have seen their balances grow by about 13% over the past year—helping to bridge the gap.

Full details in the updated Super Consumers Australia Retirement Savings Benchmarks below.

Got something we should be talking about? Tip us off - simply reply to this email!

Hello. I’m querying the numbers provided by Xavier at approx 25.50 re the amounts a single person can have in assets before the Aged pension cuts out. Xavier states that the cut off amount is $395,000, however I believe it’s $695,500. Is this correct?

Well, wasn't that a smart move by the govt att to raise pension age from 65 to 67. It has cost them more cause of all the workers who are incapacitated after 50yrs of manual work. Thanks to Joe Hockey & Mathias Cormann, may you both rot in hell👹