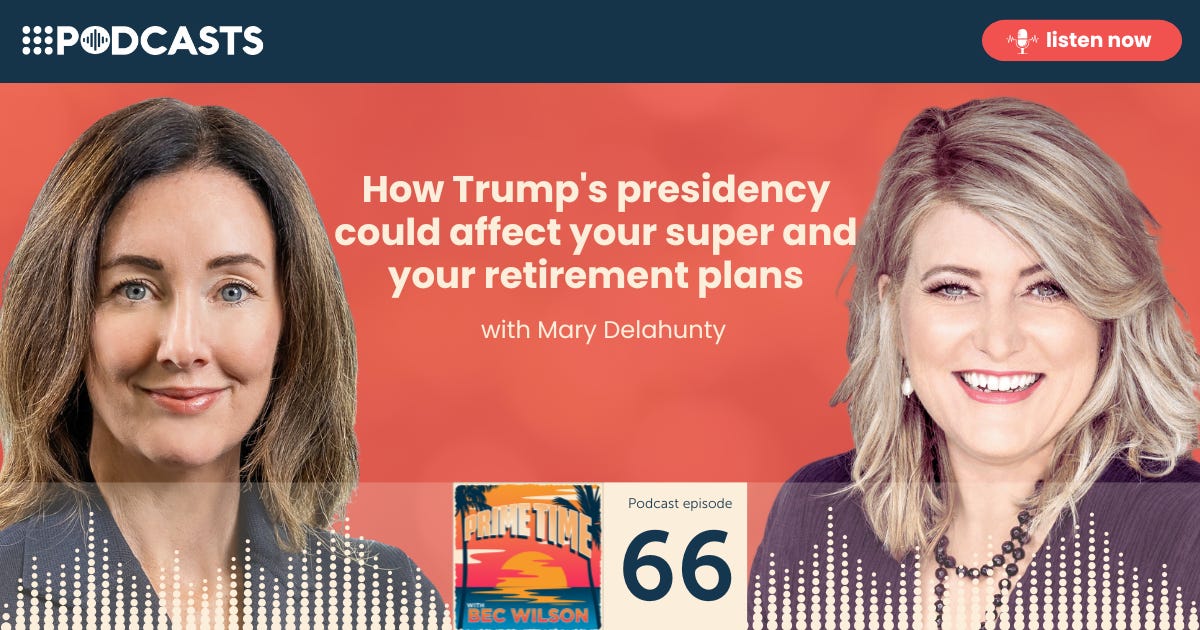

How Trump's presidency could affect YOUR super and your retirement plans

I sit down with Mary Delahunty, CEO of the Association of Superannuation Funds of Australia (ASFA), to unpack what’s really going on with your superannuation in the downturn.

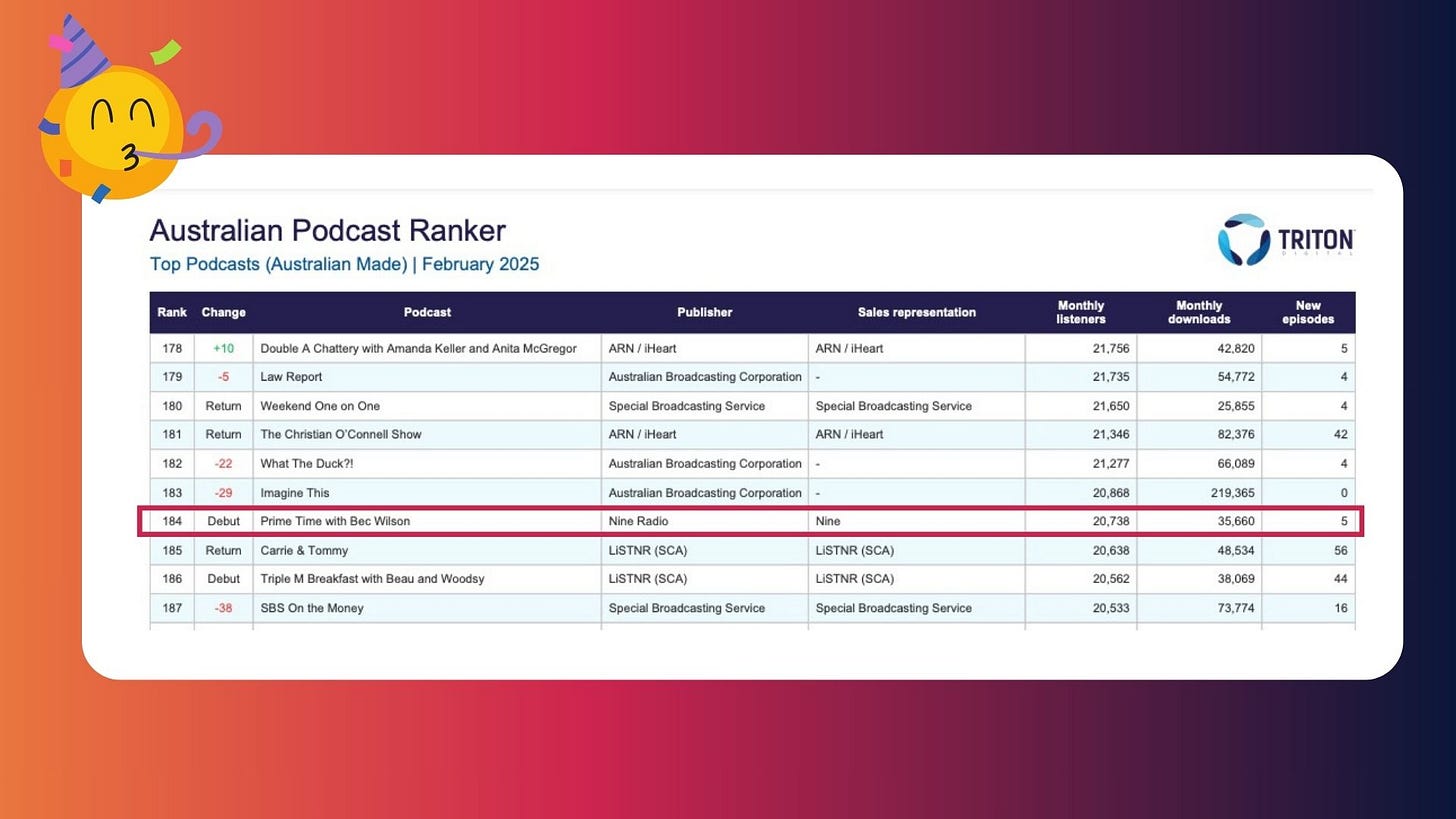

We’ve hit the big time!

Exciting news before we dive into today’s podcast! Prime Time has officially hit the big time. This week, we made our debut on the Australian Podcast Ranker’s top 200 list — coming in at #184, on this, the most prestigious podcast ranking in the country! A huge thank you to our incredible team at Nine Podcasts, our sponsors, and most importantly, to you, our listeners, for making this possible. We absolutely love it when you share the show with your friends — keep spreading the word! Let’s make more Prime Times count! Thanks everyone!

How Trump's presidency could affect YOUR super and your retirement plans

If you've been watching the markets lately and thinking about your retirement, you're probably not alone in feeling a little uneasy. I’ve been getting loads of emails from people wondering whether Trump’s latest moves will ruin their retirement and asking if it's time to move to lower-risk investments, or even to the sidelines with their super.

And i want you to stop, look and listen before you react.

In this episode of Prime Time, I sit down with Mary Delahunty, CEO of the Association of Superannuation Funds of Australia (ASFA). We unpack what’s really going on with your superannuation in the midst of this downturn and how to take a considered approach to the current volatility in the market, especially if you’re thinking about retirement.

And, we talk about what your super fund is doing to support you during these unpredictable times, and how you can tap into advice and guidance to help navigate the uncertainty.

LISTEN TO THIS EPISODE OF THE PODCAST HERE:

Highlights of this episode:

Navigating market volatility: Mary explains why markets are jumping, and why reacting to short-term volatility can be risky for your retirement.

What to do when you're worried about risk: Is it time to go conservative with your super? Mary explains how to evaluate your risk tolerance and take the right actions.

Understanding sequencing risk: The hidden danger of withdrawing from your super during market downturns and how to protect yourself.

The bucket strategy: A simple but effective strategy for managing your withdrawals in retirement, especially when markets are volatile.

How super funds are helping: What to do when you're feeling panicked – and why talking to your super fund can help you make better decisions.

Understanding how your fund will be reacting: Funds are not passive in a downturn. Mary gives us a clearer view of how your super fund will be taking steps in the investment market and capturing opportunities as they appear.

Getting the right advice: Why it’s essential to seek advice when you’re unsure, especially during turbulent times, to ensure your investments match your long-term goals.

Long-term investment mindset: How to keep your cool and stay focused on the big picture when market news feels overwhelming.

Strategies you can consider: What can you do if you feel like you have to do something.

This episode will equip you with practical strategies to help keep your retirement vision in sensible order, even when the markets feel like they're in free fall.

Want to share your thoughts? Do it in the comments here.

The next How to Have an Epic Retirement Flagship Course starts in just 3 weeks!

The next How to Have an Epic Retirement Flagship Course - The Winter Edition kicks off on the 10th April 2025. Our 25% off Earlybird discount is available but only for a limited time. So get your booking in!

What’s included?

6 weeks of on-demand video lessons dripped week by week (14 modules of content)

6 Live Q&As — one each week (most are held on Monday evenings)

A 150 page practical and professionally published workbook (exclusive to the course)

A signed copy of How to Have an Epic Retirement - the book

Access to our Community Chatroom throughout the course to interact with other students in the cohort as you learn together

You can find out more and download our new brochure on our website.

If you’re keen to join this program be sure to get your booking in as books are sent prior to the course commencement.

Until next week, make your Prime Time count!

And as always, you can reach me at bec@primetimers.net—I love hearing from you, whether it’s a tip, a question, or something I can help with.

Many thanks! Bec Wilson

Historically, I would not normally panic during a downturn and would buy more equities at lower than average prices. However, due to the orange buffoon and his nasty side kick being in charge, we are not living in normal times and I suspect unpredictability will continue to reign.

Down turns like this have happened previously and will happen again. That is just the way of the world. So in pension phase make sure to keep sufficient cash available to pay your pension and also some invested in term deposits just in case the downturn persists for a while. Then your pension will continue with no dramas and you will not be forced to access your stockmarket investments when you will just be locking in the poor sell price you will get. And in accumulation (and pension phase) don’t panic and make your paper loss a real loss by moving into cash. Our financial advisor has us set up so that no rushed decisions need to be made during a downturn. Sure it is not good to see Stockmarket down but we can sit back and not be overly concerned. Even if you can’t access paid advice, everyone should be able to get some free advice thru your superfund so please, please talk to them before taking any hurried actions now!!