'How much can you really afford to spend each year in retirement?' with Aaron Minney

Today we're talking about spending in retirement, covering two topics - the ways people phase their spending over retired years and how much on average people can afford to spend each year.

This week is all about learning to spend your hard-earned retirement funds. In episode 14 we talk about ‘safe spending’ or how you calculate the amount you can afford to spend, based on your super balance at retirement if you want your super to last to your life expectancy or a little beyond. We also talk about spending patterns in retirement, and the various different ways that people plan their annual spending budget to work over their lifetime. To talk about these tricky and interesting topics, we have Aaron Minney, the Head of Retirement Income for Challenger, who for 12 years has been researching ways to generate income from investments in retirement.

This is a topic that anyone approaching or in retirement with a fear of running out of money will really enjoy.

And below we provide you with a really helpful and detailed ‘safe spending’ analysis, thanks to the team at Challenger who have done the calculations. So keep scrolling for more.

Listen now

LISTEN HERE - LATEST EDITION (E14) - OMNY

or listen on APPLE PODCASTS

According to Aaron, there’s a simple way to work out how much money you can SAFELY spend in retirement. There’s also some good insights into the way people actually spend their money in retirement, and how you can draw on these patterns to prepare your budget for the future. And, this is changing as the baby boomer steps to the fore with larger super balances.

Here’s some highlights from this episode:

Defining safe-spending and the guidelines for how you can spend your retirement savings with a 90% or greater chance of it lasting your whole life.

How longevity and life expectancy is shaping and changing the way we think about spending our superannuation

The economic theory you SHOULD care about as you head into retirement.

How budgeting and spending in retirement are changing as we go through a big demographi shift.

The 'Commodore theory' - a real telltale sign of someone’s attitude to money in old retirement

Diving into the safe-spending specifics: The formula and how you can apply it to your super balance and expected life expectancy.

I’ll be diving even deeper into these topics in Sunday’s newspapers, which I share to my Epic Retirement Newsletter subscribers each weekend.

Safe Spending Tables

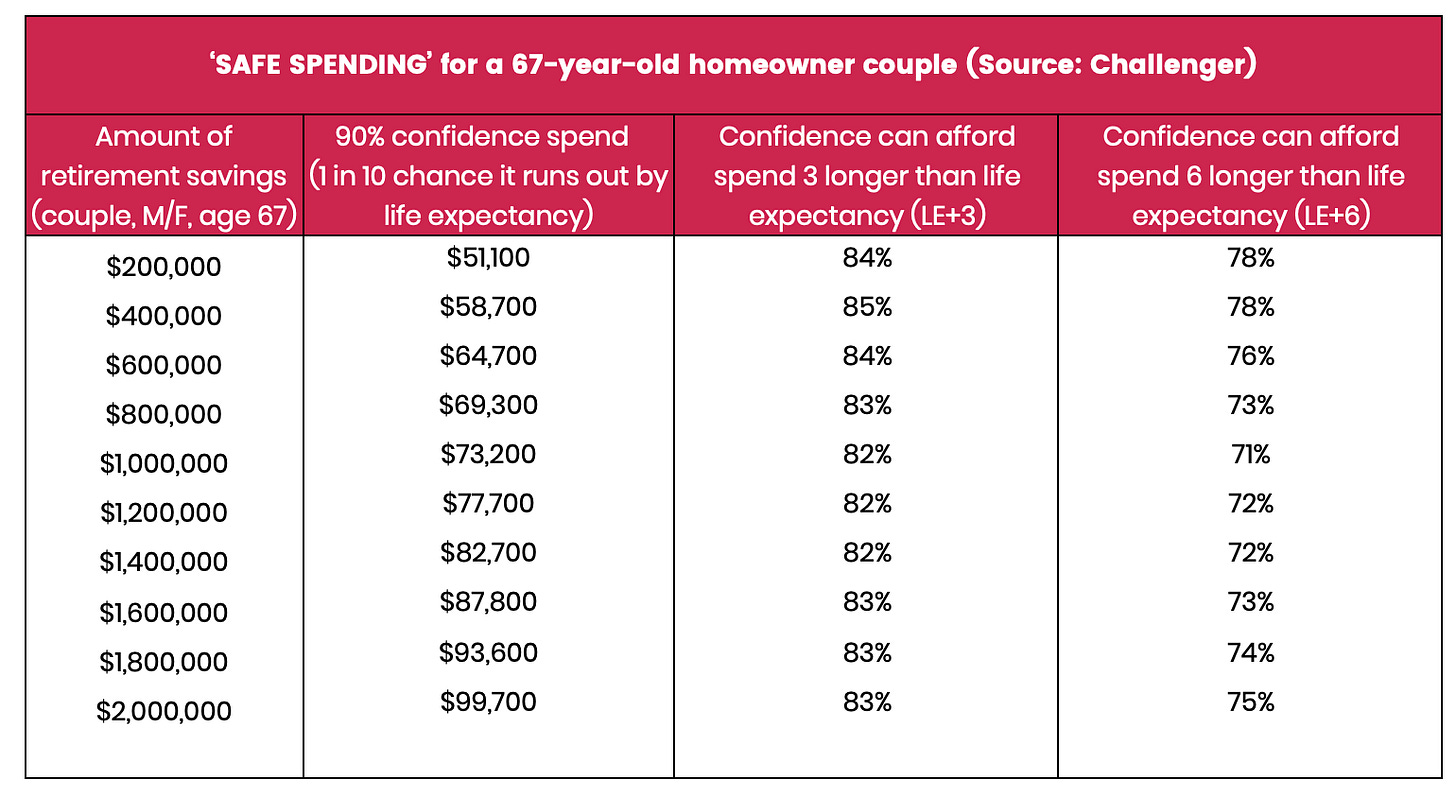

Now, here’s two different sets of safe spending tables that you can use to guide your own safe spending levels. The first is for couples sharing a super balance, and the second is for singles with their own super balance. Remember, these income amounts include the pension and an account based pension income stream from superannuation.

The below table shows the “safe spending” amount for a 67-year-old homeowner couple with different balances, where ‘safe’ is based on a 9 out of 10 chance that the spending amount (increasing annually with price inflation) will be sustainable to the life expectancy of the couple when investing all savings in a 50% growth risk profile account-based pension (ABP). The table also illustrates the confidence the spending would be sustainable to 6 years beyond life expectancy. Similarly table 2 is for a 67 year old homeowner single woman

Table 1 - COUPLES

Table 2 - SINGLE PEOPLE

Please see the bottom of the email for detailed notes on Challenger’s methodology.

Don’t forget: 6 weeks of epic retirement education kicks off on 11 March

This is the only comprehensive, modern, 6 week 'get ready for retirement' program available in Australia.

And Early Bird 50% off pricing closes at midnight on the 4th March 2024.

The How to Have an Epic Retirement Flagship Course is booking up. That's because it's more than just a course - it's a well-rounded program!

🌴 There's 14 modules/8.5 hours of education videos, dripped by week

🌴 Live Q&As with retirement experts each week

🌴 A practical 85 page digital workbook and quizzes embedded into the weekly program

🌴 An engaging online community for course participants

🌴 And a signed copy of the 2024 edition that has JUST gone to print of How to Have an Epic Retirement - the book

Complete the program alongside a whole cohort approaching retirement. Learn how to make your retirement truly epic and have fun doing it.

Our Epic Course Live Q&A guests on this program include: (Full profiles on our brochure which you can download here)

Notes on Challenger’s methodology and assumptions

The completed analysis above is based on Challenger’s Retirement Illustrator for retirees aged 67 with all savings in superannuation.

The likelihood that spending will be sustainable to 3 and 6 years past life expectancy is presented in the analysis. Life expectancy is calculated based on the AGA 2015-17 life tables with 25yr mortality improvements.

The analysis considers homeowners of a particular age and risk profile with all savings invested in the tax-free retirement phase of superannuation. Confidence of spending may differ for retirees with different characteristics e.g. non-homeowners, other risk profiles, different ages, if have savings held outside super. Additional scenarios could be considered by utilising Challenger’s Retirement Illustrator.

Annual spending is assumed to increase annually with price inflation. Each retirement strategy is analysed over 2,000 simulations of market returns and inflation from the Moody’s Analytics Scenario Generator. Age Pension is modelled based on December 2023 Age Pension rates and thresholds.

Income to meet annual spending requirements is sourced from the estimated Age Pension, income from the ABP (subject to the minimum pension requirements). If income exceeds the target spending amount the excess income is assumed to be saved outside super in cash and is used to fund future spending once the ABP is exhausted. The modelling does not make any allowance for tax payable on income earned on non-superannuation cash balances. All other fees and assumptions are per the default assumptions in the Retirement Illustrator. Detail on assumptions and methodology can be found in the Retirement Illustrator Assumptions guide dated September 2023. The use of Challenger’s Retirement Illustrator is further subject to all the terms of use and assumptions provided by Challenger to licensees and/or advisers and must be read and understood prior to the use of this tool.

Disclaimer: Information provided in this newsletter is general in nature and is prepared for educational purposes only and does not constitute general or personal financial advice. Please seek personal financial advice before making any significant financial decison. Bec Wilson is not a financial adviser and provides this information for educational purposes only. While we make every effort to present factual and up-to-date information, please do not assume the information is without error. Always do your own research.

That was a great session. Thank you. Can we use the retirement illustrator calculator? I just tried but it appears that only financial planners can do that.

Hi

Is there a table for how much you will need for retiring at 60, I could think of nothing worse than to still be working at 67