Do you want to retire early?

Thinking about pulling the pin early on work? This episode of Prime Time dives deep into what it really takes to retire before 60 with Drew Meredith from Wattle Partners.

Thinking about pulling the pin early on work? This episode of Prime Time dives deep into what it really takes to retire before 60 — and why it’s not just about scrimping and living on two-minute noodles. Bec is joined by wealth expert Drew Meredith from Wattle Partners to unpack what financial independence truly means, who early retirement suits, and how to actually fund those golden years (and silver ones, and legacy ones too).

Whether you're aiming to leave your job in your 50s or just want more lifestyle freedom, this episode is packed with practical guidance, honest perspectives, and a few laughs about budgets, buckets, and breaking free from the grind.

LISTEN TO THIS EPISODE OF THE PODCAST HERE:

Highlights of this episode:

What FIRE really means (and why it's not always the goal): Bec and Drew discuss the original Financial Independence, Retire Early (FIRE) concept — and how it's being redefined by people who want flexibility, not frugality.

Early retirement is really about choice: It's less about never working again and more about having the option to pivot, retrain, or slow down.

Why younger generations are embracing FIRE: From work flexibility to housing affordability, Drew explains why under-40s are eyeing alternative paths.

The financial reality check: Want to stop work before 60? You'll need two “buckets” — one for the years before you can access super, and one for retirement proper.

Budgeting by phases (yep, the B-word): Bec explains her phased approach — setup years, lifestyle years, and part-time pre-retirement — and how different budgets apply to each.

The role of investing — and why you can't play it too safe: Drew shares how investing for growth (not just income) is essential if your retirement could stretch 30+ years.

The psychology of spending in retirement: Many early retirees struggle to shift from saving to spending. Bec and Drew talk about realigning your mindset and building confidence in your plan.

How much do you really need?: Drew gives ballpark figures — $60k to $120k a year (after tax) for a comfortable retirement — and explains how tax-effective super helps make it work.

The underrated power of superannuation: Learn why many Australians don’t maximise their super and how engaging with it earlier can open doors to retiring earlier, better.

Common pitfalls to avoid:

Underestimating how long you’ll live

Failing to plan for the “gap” years before 60

Being too conservative with investments

Forgetting that spending patterns shift as retirement unfolds

💡 Takeaway:

If you want to retire early, it’s not just about saving more — it’s about planning smarter, thinking in phases, and setting yourself up with the right mix of cash flow, investments, and confidence to live life on your terms.

We’re getting ready to kick off – are you in?

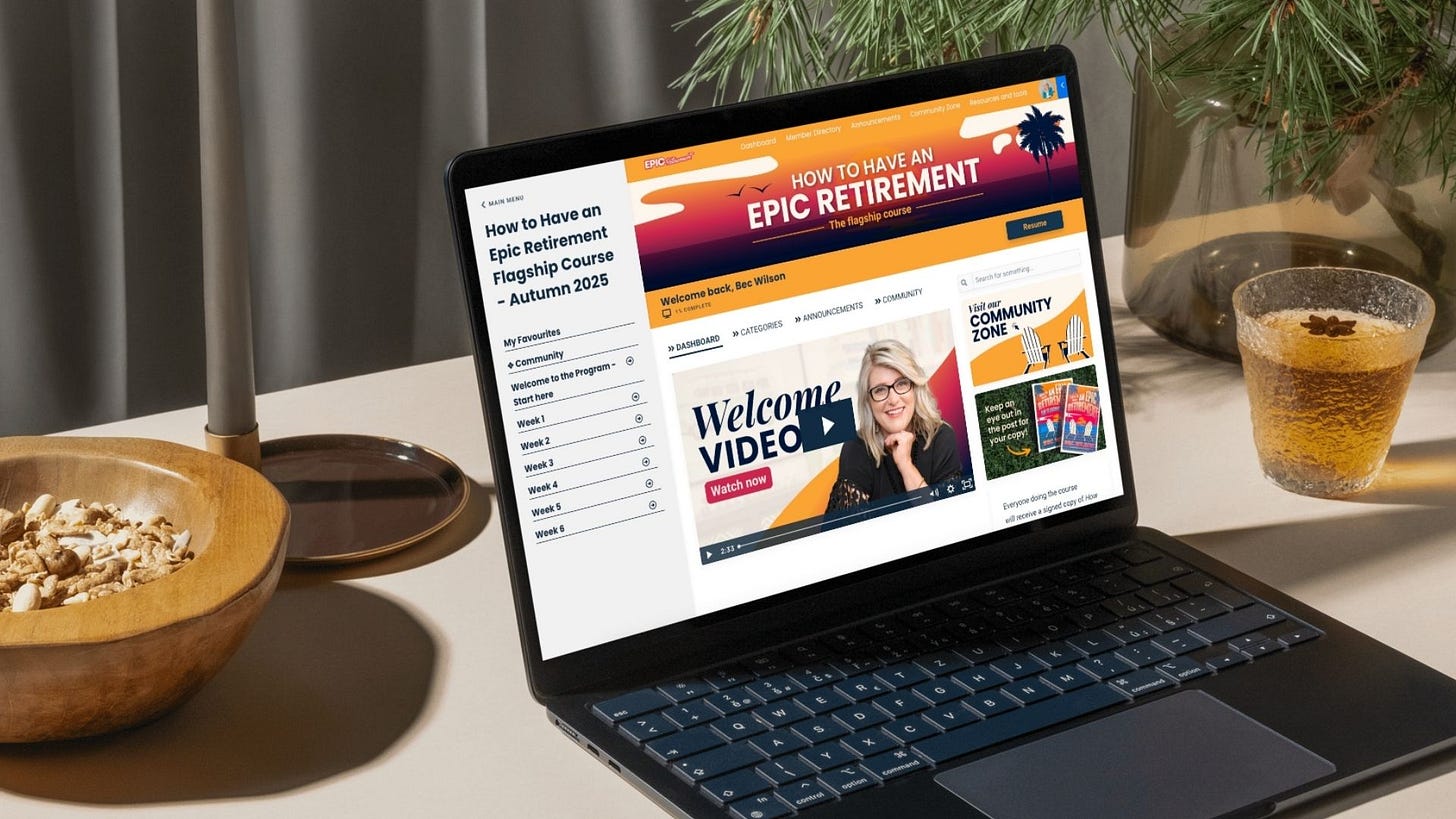

The How to Have an Epic Retirement Flagship Course kicks off on the 10th April, and we’re sending out the welcome packs this week to everyone who's coming along. It’s six weeks of practical, engaging, real-life retirement planning—designed to help you feel more confident, more in control, and ready to shape your next chapter.

Here’s what’s included:

Six weeks of well-structured online learning, delivered across 14 modules

Six live Q&A events with some of Australia’s top retirement experts (mostly Monday nights, with a break for Easter)

A professionally published, 150-page workbook—exclusive to participants

A signed copy of How to Have an Epic Retirement

And a few surprises along the way

This course gets rave reviews. In fact, 100% of participants in the most recent intake said they’d recommend it to a friend—and they told us their retirement confidence had significantly improved thanks to the program.

📥 Download the brochure here

📅 Book your place here

I’ve got a coupon code that will give Prime Time subscribers 15% off the RRP if you missed the earlybird deal: LASTCALLW25

Here’s some fresh new testimonials from our Autumn program that only wrapped up last week! 😎

“I found this course to be a breath of fresh air in the retirement space. Bec and her team provide you with a holistic experience that doesn't just cover th financial aspects of retirement. It delves into budgeting (and provides some fantastic resources in this area), retirement planning, mental wellbeing, health and ageing and travel. In the process she enlists the help of experts in these various fields. the workbook she provides is very professional and extremely helpful. After completing the course I have a much better idea of what my epic retirement will look like AND what I need to do to make sure it happens. Thank you so much Bec and all the other experts we spoke to in our course. You guys are making a real difference for pre-retirees and retirees.”

“My husband and I completed the course together. We've both learned so much and have lots of homework to complete so that our retirement is EPIC. Most importantly, the course has opened up so many points of discussion and helped us get on the same page and we move into the next 30 years of our lives.”

Before you quit your job and sell the house... read this!

Everything I share here is general information, not personal financial, legal or tax advice. It hasn’t been tailored to your specific life, goals, money situation, or brilliant retirement plans—so before making any big decisions, please chat to a licensed financial adviser or relevant professional who can look at your individual circumstances.

I do my best to keep things accurate and current, but I can’t guarantee it (rules change, governments shuffle things around, and I’m only human). Any figures or examples are just that—examples—to help explain things, and they might not reflect the latest laws or your actual numbers.

Use this as a helpful guide, not gospel.